Optimize Your Advantages with VA Home Loans: Lower Interest Rates and Flexible Terms

Optimize Your Advantages with VA Home Loans: Lower Interest Rates and Flexible Terms

Blog Article

Navigating the Home Loans Landscape: Exactly How to Take Advantage Of Financing Solutions for Long-Term Wealth Structure and Protection

Browsing the complexities of home financings is essential for anyone aiming to construct riches and make sure monetary safety and security. Comprehending the various sorts of funding options offered, along with a clear assessment of one's economic situation, prepares for informed decision-making. By utilizing critical borrowing techniques and keeping home worth, people can improve their long-lasting riches possibility. The complexities of efficiently using these services raise vital questions regarding the finest methods to adhere to and the challenges to prevent. What approaches can absolutely maximize your investment in today's volatile market?

Comprehending Home Finance Kinds

Home mortgage, a crucial element of the real estate market, come in different types developed to fulfill the diverse needs of customers. One of the most typical sorts of home finances include fixed-rate home loans, variable-rate mortgages (ARMs), and government-backed loans such as FHA and VA financings.

Fixed-rate mortgages supply security with consistent regular monthly settlements throughout the financing term, commonly ranging from 15 to thirty years. This predictability makes them a prominent option for new property buyers. On the other hand, ARMs feature rate of interest that rise and fall based upon market conditions, often resulting in reduced initial settlements. However, debtors should be planned for possible rises in their monthly responsibilities in time.

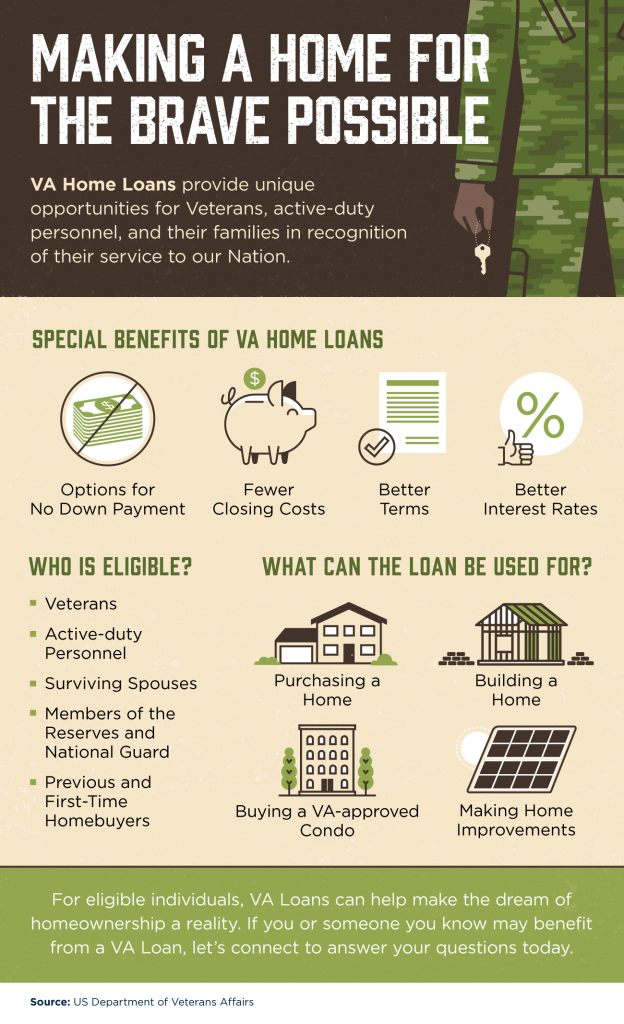

Government-backed financings, such as those guaranteed by the Federal Real Estate Management (FHA) or ensured by the Department of Veterans Matters (VA), provide to details teams and commonly call for lower down settlements. These financings can help with homeownership for individuals that might not certify for traditional funding.

Examining Your Financial Situation

Assessing your economic situation is an important action in the home mortgage procedure, as it lays the structure for making informed loaning choices. Begin by analyzing your earnings sources, including salaries, incentives, and any type of additional profits streams such as rental residential or commercial properties or financial investments. This comprehensive sight of your earnings assists lending institutions establish your borrowing capability.

Next, assess your costs and month-to-month responsibilities, including existing financial obligations such as debt cards, student loans, and auto settlements. A clear understanding of your debt-to-income ratio is vital, as most loan providers like a proportion listed below 43%, ensuring you can manage the new home mortgage settlements alongside your existing responsibilities.

Additionally, assess your credit rating, which considerably affects your funding terms and passion prices. A greater credit report shows financial reliability, while a reduced rating may necessitate methods for enhancement before applying for a lending.

Last but not least, consider your cost savings and possessions, including emergency situation funds and fluid investments, to guarantee you can cover down settlements and closing expenses. By diligently reviewing these elements, you will be much better positioned to navigate the mortgage landscape efficiently and protect financing that aligns with your long-term monetary goals.

Techniques for Smart Loaning

Smart borrowing is vital for navigating the intricacies of the mortgage market efficiently. To optimize your borrowing approach, begin by recognizing your credit rating account. A strong credit history can dramatically lower your rate of interest, equating to considerable cost savings over the life of the finance. On a regular basis checking your credit scores report and addressing inconsistencies can boost your rating.

Next, take into consideration the kind of home mortgage that best suits your financial scenario. Fixed-rate loans supply stability, while variable-rate mortgages may supply reduced preliminary repayments however bring threats of future rate boosts (VA Home Loans). Examining your long-lasting strategies and economic capacity is crucial in making this decision

Additionally, aim to secure pre-approval from lending institutions prior to house hunting. When making a deal., this not only provides a more clear photo of your budget yet also reinforces your negotiating setting.

Long-Term Riches Building Methods

Building long-lasting wide range with homeownership requires a strategic approach that surpasses simply securing a home mortgage. One reliable strategy is to think about the recognition potential of the property. Selecting homes in growing neighborhoods or areas with prepared developments can cause considerable increases in home worth gradually.

An additional essential facet is leveraging equity. As mortgage settlements Full Article are made, house owners construct equity, which can be used for future investments. Making use of home equity financings or credit lines wisely can give funds for additional property visit our website financial investments or restorations that even more enhance property worth.

Furthermore, maintaining the residential property's problem and making calculated upgrades can significantly contribute to long-term wealth. Simple renovations like modernized washrooms or energy-efficient appliances can yield high returns when it comes time to sell.

Finally, comprehending tax benefits associated with homeownership, such as mortgage rate of interest deductions, can enhance economic end results. By optimizing these benefits and embracing a proactive financial investment mindset, house owners can grow a durable portfolio that promotes lasting wide range and stability. Inevitably, a well-shaped approach that focuses on both property option and equity management is crucial for lasting riches building via realty.

Keeping Financial Safety

/mortgagemarvel/VA_Mortgage_Home_Loans_Florida_Tampa_Clearwater_Macdill_AFB_Wesley_Chapel_Riverview_South_Tampa_Hyde_Park__Unconventional_lending_Derek_Bissen-s7a34.jpg)

Moreover, fixed-rate home loans use foreseeable month-to-month settlements, allowing better budgeting and monetary preparation. This predictability safeguards property owners from the changes of rental markets, which can cause unexpected increases in housing expenses. It is vital, however, to ensure that mortgage payments stay manageable within the wider context of one's financial landscape.

By incorporating homeownership with various other economic instruments, individuals can develop a balanced technique that alleviates risks and enhances overall economic security. Inevitably, keeping monetary protection through homeownership calls for a aggressive and enlightened approach that stresses careful preparation and ongoing persistance.

Verdict

In conclusion, properly browsing the home financings landscape necessitates a comprehensive understanding of various car loan types and an extensive analysis of private Go Here economic scenarios. Carrying out critical loaning methods facilitates long-term wealth build-up and safeguards economic stability.

Browsing the intricacies of home fundings is crucial for any person looking to construct wide range and make sure financial protection.Evaluating your financial scenario is a vital step in the home funding process, as it lays the foundation for making informed loaning decisions.Homeownership not only serves as a car for long-lasting wealth building however likewise plays a significant role in keeping economic protection. By integrating homeownership with various other financial tools, individuals can develop a well balanced approach that reduces risks and boosts general financial security.In verdict, effectively navigating the home finances landscape requires a thorough understanding of different finance types and a detailed evaluation of specific financial scenarios.

Report this page